Can I withdraw money from an ATM in another country?

Can you withdraw money from an ATM in a foreign country

Yes. As long as your ATM or credit card has either a Visa or PLUS logo, you can withdraw cash at ATMs that are part of the Visa or PLUS network. How do I find an ATM in the country that I'm traveling to Visa is accepted at over 200 countries and territories around the world.

How do I withdraw money internationally

Cash & ATMs

ATMs are the best way to access money abroad and are increasingly available. Your bank or credit card company may charge fees for withdrawals overseas and may have a limit on the amount you can withdraw daily, so be sure to consult with your bank about this.

What is the foreign ATM withdrawal fee

1% to 3%

Foreign transaction fees are charged by your bank for currency conversion. If your bank charges foreign transaction fees — and many do — you'll pay a percentage of the total withdrawal amount, usually 1% to 3%, for using your card at a foreign ATM (or anywhere else abroad).

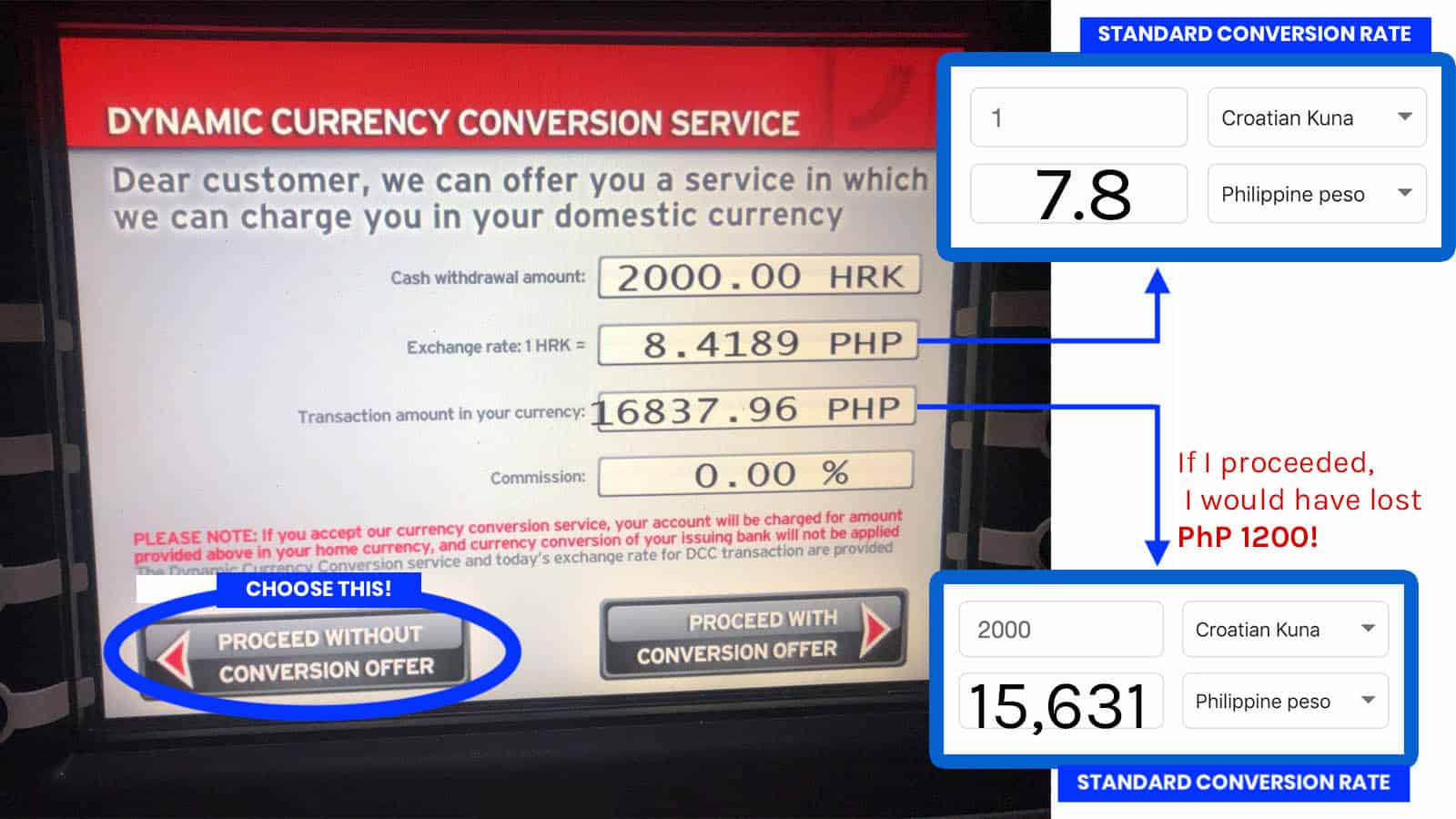

How can I avoid ATM fees in Europe

How to Avoid ATM Fees When Traveling AbroadUse an ATM in Your Bank's International Network.Use Your Debit Card to Get Cash Back at a Store.Don't Use the ATM's Conversion Offer.Use a Bank That Doesn't Charge International ATM Fees.Use a Bank That Refunds ATM Fees.Use a Credit Card Without a Foreign Transaction Fee.

Can I use ATM in Europe

You can visit a bank when you get to Europe and withdraw money from an ATM using your debit card. Some checking accounts may charge a fee when you use your debit card at ATMs abroad. And some banks might also charge a foreign transaction fee.

Can I use my ATM card in Europe

Debit cards from any major US bank will work in any standard European bank's ATM (ideally, use a debit card with a Visa or MasterCard logo). As for credit cards, Visa and MasterCard are universal, American Express is less common, and Discover is unknown in Europe.

What is the best way to get cash in Europe

By far one of the easiest ways to secure cash in Europe is to simply withdraw the right currency from ATMs during your travels. ATM withdrawals are often a hassle-free way to get cash. ATMs are everywhere across Europe, especially in the busiest hubs and almost all machines have English language options.

How much does ATM charge in Europe

All Euro ATM withdrawals are fee-free, giving you free rein to travel the Eurozone. Outside of the Eurozone, ATM withdrawals cost 1.7% per withdrawal.

How much does it cost to withdraw money from ATM in Europe

All Euro ATM withdrawals are fee-free, giving you free rein to travel the Eurozone. Outside of the Eurozone, ATM withdrawals cost 1.7% per withdrawal.

How much is EU ATM fee

All Euro ATM withdrawals are fee-free, giving you free rein to travel the Eurozone. Outside of the Eurozone, ATM withdrawals cost 1.7% per withdrawal.

Can I use my debit card at any ATM in Europe

The simple answer is yes, you can. However, in order to not pay any extra fees, withdraw cash from an ATM machine bearing one of the symbols found on the front or back of your Debit Card. These days, many European ATM machines show both the VISA or MasterCard and none of the cash networks symbols.

What ATMs are not used in Europe

Many European banks place their ATMs in a small entry lobby, which protects users from snoopers and bad weather. To get in, look for a credit-card-size slot next to the door and insert your card. Avoid "independent" ATMs, such as Travelex, Euronet, Moneybox, Your Cash, Cardpoint, and Cashzone.

How can I use my ATM for cash in Europe

Simple Checklist for Using Your Debit and Credit Cards in EuropeCall your bank before leaving.Your ATM card's pin number must have 4 digits.Withdraw cash only by using your ATM card.Know your cards' fees.Increase your daily maximum cash withdrawal.While abroad, withdraw cash only from a local bank ATM machine.

Is it better to use ATM in Europe

Key Takeaways. European travelers should always have some cash on hand; getting it from an ATM abroad is usually the easiest, most advantageous way. If you need cash from an ATM, it's usually better to use a debit card, because credit cards often charge a high interest rate for a cash advance.

Can I use my ATM in Europe

Know your cards.

Debit cards from any major US bank will work in any standard European bank's ATM (ideally, use a debit card with a Visa or MasterCard logo). As for credit cards, Visa and MasterCard are universal, American Express is less common, and Discover is unknown in Europe.

How much can you take out of an ATM in Europe

Cash withdrawal: limits and amounts

Your cash withdrawal limit varies from bank to bank. Most ATM withdrawal limits are between €200–€300 a day. Always be aware of your bank's withdrawal limit, especially if the money you need exceeds that amount.

Can I use my debit card in the EU

These are the most common questions I get about using debit and credit cards in Europe. The simple answer is yes, your debit and credit card will work in Europe. Using your credit card and debit card in Europe is very easy these days thanks to global financial networks.

Can you withdraw money from ATM in Europe

Tip: Using an ATM Debit Card is still the best way of withdrawing money in Europe. You'll pay withdrawal fees, but you'll still get a better rate than you would exchanging cash for local cash at a currency exchange rate.

Which ATM to use in Europe

Many European banks place their ATMs in a small entry lobby, which protects users from snoopers and bad weather. To get in, look for a credit-card-size slot next to the door and insert your card. Avoid "independent" ATMs, such as Travelex, Euronet, Moneybox, Your Cash, Cardpoint, and Cashzone. These have high fees.

Do ATMs charge a fee in Europe

All Euro ATM withdrawals are fee-free, giving you free rein to travel the Eurozone. Outside of the Eurozone, ATM withdrawals cost 1.7% per withdrawal.

What happens if I use my debit card internationally

While you can typically use a debit cards in another country, you may have to pay a foreign transaction fee. Though these fees vary by bank and card issuer, they are usually around 3% of any transaction abroad.

Do I get charged for using my debit card abroad

You may be charged for using your debit or credit card abroad to buy something or when you withdraw cash in a foreign currency. What you'll pay depends on the transaction you make and the card you use. You can also compare EEA currency conversion charges while travelling.

Is it better to take Euros or use debit card

European travelers should always have some cash on hand; getting it from an ATM abroad is usually the easiest, most advantageous way. If you need cash from an ATM, it's usually better to use a debit card, because credit cards often charge a high interest rate for a cash advance.