How much money can you put into Barclays?

How much cash can I deposit in Barclays bank

Use our self-service machines

Skip the queue and deposit up to £4,000 in cash or a cheque of any value at one of our self-service machines – available at the majority of our branches.

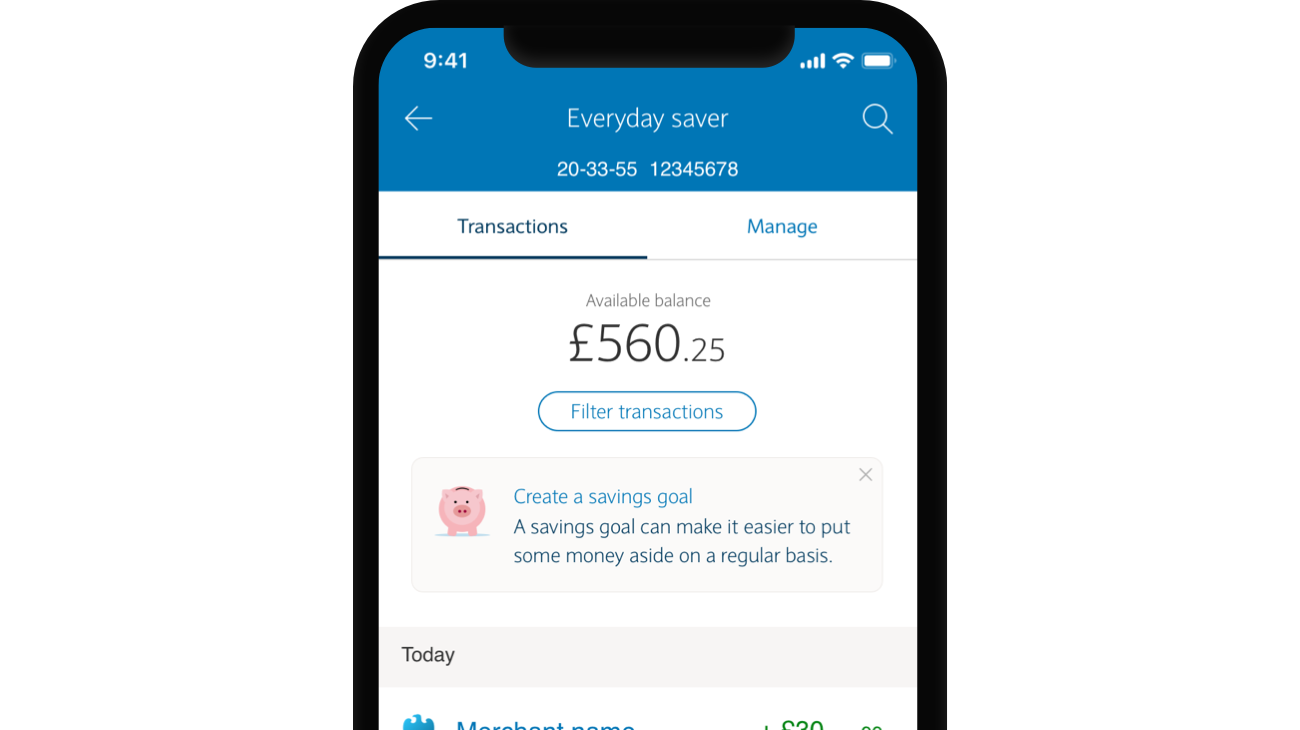

What’s the transfer limit on Barclays

Account type

| Account type | App (New Payees) | Transfers between my accounts (per payment) |

|---|---|---|

| Personal | £2,000 | £250,000 |

| Premier | £5,000 | £250,000 |

| Business | £7,500 | £250,000 |

How do I put money into my Barclays account

There are various ways to pay into Barclays accounts, including:Paying the cash in at your own bank, then using online, mobile or telephone banking to make the payment.Setting up a standing order – your bank can help with this.

Can you deposit cash at ATM Barclays

You can use our self-service machine to pay in cash and cheques, view your balance and transfer money between accounts. You can also make payments to other people and pay your bills. All you need is your Barclays debit card and the details of who you're paying.

How much cash can I deposit at once

A cash deposit of more than $10,000 into your bank account requires special handling. The IRS requires banks and businesses to file Form 8300, the Currency Transaction Report, if they receive cash payments over $10,000. Depositing more than $10,000 will not result in immediate questioning from authorities, however.

Is there a limit on cash deposits UK

Deposit limits: banks to reduce cash deposit limits, subject to their customer arrangements, to below the existing £20,000 per transaction.

Is there a limit to how much money you can put in the bank

What are Maximum Deposit Limits Generally speaking, banks and credit unions don't impose maximum deposit limits on checking and savings. This means that there usually is not a maximum deposit amount for your checking account that you need to know. The same applies for savings accounts.

How do I transfer 100k to another bank

Steps for Transferring Money Between BanksLog into your bank's website or connect via the bank's app.Click on the transfer feature and choose transfer to another bank.Enter the routing and account numbers for the account at the other bank.Make the transfer.

What is the limit for cash deposit

A cash deposit of more than $10,000 into your bank account requires special handling. The IRS requires banks and businesses to file Form 8300, the Currency Transaction Report, if they receive cash payments over $10,000. Depositing more than $10,000 will not result in immediate questioning from authorities, however.

How much cash can I deposit

If you plan to deposit a large amount of cash, it may need to be reported to the government. Banks must report cash deposits totaling more than $10,000. Business owners are also responsible for reporting large cash payments of more than $10,000 to the IRS.

Can I deposit $5000 cash in bank

Depending on the situation, deposits smaller than $10,000 can also get the attention of the IRS. For example, if you usually have less than $1,000 in a checking account or savings account, and all of a sudden, you make bank deposits worth $5,000, the bank will likely file a suspicious activity report on your deposit.

Can you deposit $10000 in cash

A cash deposit of more than $10,000 into your bank account requires special handling. The IRS requires banks and businesses to file Form 8300, the Currency Transaction Report, if they receive cash payments over $10,000. Depositing more than $10,000 will not result in immediate questioning from authorities, however.

Can I deposit 20k in cash

A cash deposit of more than $10,000 into your bank account requires special handling. The IRS requires banks and businesses to file Form 8300, the Currency Transaction Report, if they receive cash payments over $10,000. Depositing more than $10,000 will not result in immediate questioning from authorities, however.

Can I deposit 5 000 cash in bank UK

If you pay in £5,000 cash in one day at a branch, you cannot pay in any more cash through a Post Office® or Cash & Deposit Machine that day (your £3,000 daily limit is now £0).

What happens if you transfer more than 10000

If transactions involve more than $10,000, you are responsible for reporting the transfers to the Internal Revenue Service (IRS). Failing to do so could lead to fines and other legal repercussions.

How to transfer $50,000 between banks

Steps for Transferring Money Between BanksLog into your bank's website or connect via the bank's app.Click on the transfer feature and choose transfer to another bank.Enter the routing and account numbers for the account at the other bank.Make the transfer.

Can I deposit $20000 in cash

If you plan to deposit a large amount of cash, it may need to be reported to the government. Banks must report cash deposits totaling more than $10,000. Business owners are also responsible for reporting large cash payments of more than $10,000 to the IRS.

Can you deposit $5000 in cash

How much cash can you deposit You can deposit as much as you need to, but your financial institution may be required to report your deposit to the federal government.

Is depositing $5,000 suspicious

Depending on the situation, deposits smaller than $10,000 can also get the attention of the IRS. For example, if you usually have less than $1,000 in a checking account or savings account, and all of a sudden, you make bank deposits worth $5,000, the bank will likely file a suspicious activity report on your deposit.

Can I deposit $25 000 cash

A cash deposit of more than $10,000 into your bank account requires special handling. The IRS requires banks and businesses to file Form 8300, the Currency Transaction Report, if they receive cash payments over $10,000. Depositing more than $10,000 will not result in immediate questioning from authorities, however.

Can I deposit $20000 cash in bank

If you plan to deposit a large amount of cash, it may need to be reported to the government. Banks must report cash deposits totaling more than $10,000. Business owners are also responsible for reporting large cash payments of more than $10,000 to the IRS.

What happens if I deposit 50000 cash

Rule 114B of the income tax rules makes it mandatory for an individual to quote his/her PAN if the cash deposit in a single day either with a bank or post office exceeds Rs 50,000 in a single day. However, quoting PAN is not mandatory if the amount deposited does not exceed Rs 50,000 in a single day.

Can I deposit 20000 cash in bank UK

Deposit limits: banks to reduce cash deposit limits, subject to their customer arrangements, to below the existing £20,000 per transaction.

Can I deposit 50000 cash in bank

If you plan to deposit a large amount of cash, it may need to be reported to the government. Banks must report cash deposits totaling more than $10,000. Business owners are also responsible for reporting large cash payments of more than $10,000 to the IRS.

Can I transfer 100000 from my bank to another

There is no cap on the amount of money that can be transferred. However, individual banks may set a limit.