How do you profit from funds?

How do you make money from a fund

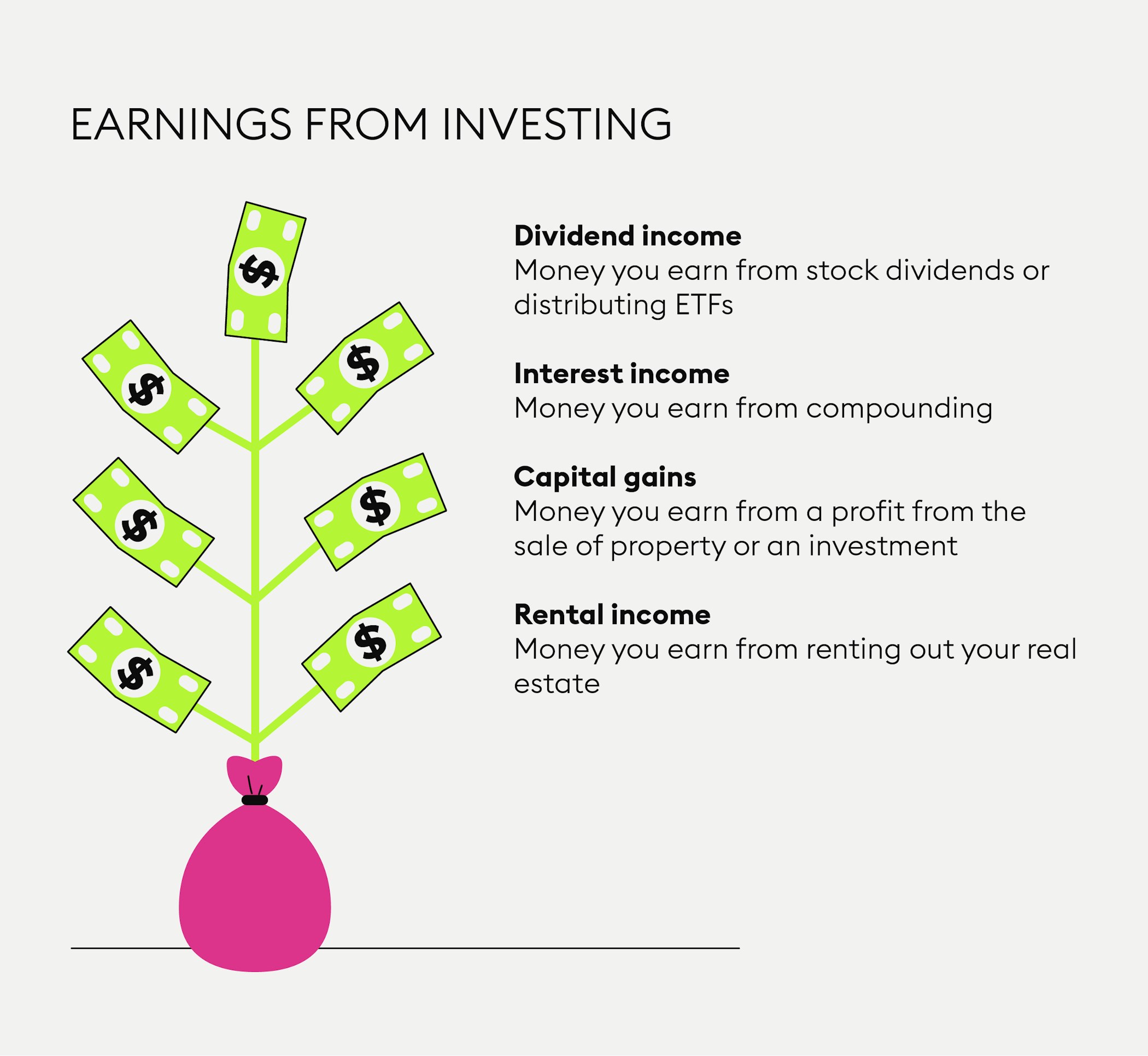

When you invest in mutual funds, you can earn in two different ways – through dividends and capital gains. The funds that were invested in stocks provide dividends based on their market earnings. If you choose to receive these dividends, then you earn this amount.

How do you profit from mutual funds

3. How investors can make money with mutual fundsAppreciation in the fund's NAV, which happens if the fund's investments increase in price while you own the fund.Income earned from dividends on stocks or interest on bonds.Capital gains or profits incurred when the fund sells investments that have increased in price.

How do you profit from investments

Actually, it isn't hard, so long as you adhere to some proven practices―and practice patience.Buy and Hold. There's a common saying among long-term investors: “Time in the market beats timing the market.”Opt for Funds Over Individual Stocks.Reinvest Your Dividends.Choose the Right Investment Account.

How do you profit from index funds

As with other mutual funds, when you buy shares in an index fund you're pooling your money with other investors. The pool of money is used to purchase a portfolio of assets that duplicates the performance of the target index. Dividends, interest and capital gains are paid out to investors regularly.

How do funds work

Funds are collective investments, where your and other investors' money is pooled together and spread across a wide range of underlying investments, helping you spread your overall risk. The value of investments can fall as well as rise and you could get back less than you invest.

How to invest $1,000 and make a profit

How to invest $1,000 right now — wherever you are on your financial journeyBuild an emergency fund. An emergency fund is crucial to your financial health.Pay down debt.Put it in a retirement plan.Open a certificate of deposit (CD)Invest in money market funds.Buy treasury bills.Invest in stocks.Use a robo-advisor.

How do you make money from ETFs

Most ETF income is generated by the fund's underlying holdings. Typically, that means dividends from stocks or interest (coupons) from bonds. Dividends: These are a portion of the company's earnings paid out in cash or shares to stockholders on a per-share basis, sometimes to attract investors to buy the stock.

How to invest $100 dollars to make $1,000

29+ Ways To Invest $100 Make $1000 A DayDropshipping Business.Start An E-Commerce Business.Robo Advisors.Start A Blog.Savings Account.Invest In Cryptocurrency.Invest In The Stock Market.Use Fractional Shares To Buy Stocks.

How to make $10,000 fast

Here are some of the best and most practical ways to make $10,000 fast so you can be prepared for whatever financial needs come your way:Get a Side Hustle.Sell Unwanted Jewelry.Sell Your Unwanted Stuff.Rent Out Your Spaces.Rent Out Your Stuff.Set up Passive Income Streams.Invest in Real Estate.

How do you make money with ETFs

Dividend-paying equity ETFs offer potential capital gains from increases in the prices of the stocks your ETF owns, plus dividends paid out by those stocks. Bond fund ETFs may provide more reliable interest income from investments held in government bonds, agency bonds, municipal bonds, corporate bonds, and more.

Are index funds free money

Yes, index funds have fees, but they are generally much lower than those of competing products. Many index funds offer fees of less than 0.4%, whereas active funds often charge fees of more than 0.77%.13 This difference in fees can have a large effect on investors' returns when compounded over longer time frames.

Are funds a good investment

Funds give you access to lots of shares, bonds or other assets in a convenient package. By investing in this way, you can spread risk and ensure your investments all serve a particular area or theme.

What is the difference between money and funds

Money i.e. bank notes and coins recognized by the government used in exchange of goods and services is known as Cash. Any sum of money in the form reserves which is saved for a certain purpose is known as Fund.

How to invest $100k to make $1 million

Consider investing in rental properties or real estate investment trusts (REIT). The real estate market is a fertile setting for a $100k investment to yield $1 million. And it's possible for this to happen between 5 to 10 years. You can achieve this if you continue to add new properties to your portfolio.

How to make millions in 10 years

GOBankingRates spoke to financial pros to get their best tips for becoming a millionaire in 10 years or less.Ensure You're Getting Paid What You Are Worth.Have Multiple Income Streams.Save as Much as You Possibly Can.Make Savings Automatic.Keep Debt to a Minimum.Don't Fall Victim to 'Shiny Ball Syndrome'

Are ETFs good for beginners

ETFs are great for stock market beginners and experts alike. They're relatively inexpensive, available through robo-advisors as well as traditional brokerages, and tend to be less risky than investing individual stocks.

Why ETFs are good for beginners

Exchange traded funds (ETFs) are ideal for beginner investors due to their many benefits such as low expense ratios, abundant liquidity, range of investment choices, diversification, low investment threshold, and so on.

How much is $100 a month for 30 years

You plan to invest $100 per month for 30 years and expect a 6% return. In this case, you would contribute $36,000 over your investment timeline. At the end of the term, your bond portfolio would be worth $97,451. With that, your portfolio would earn more than $61,000 in returns during your 30 years of contributions.

How to make $200 dollars fast in one day

8 Ways To Make $200 in Just a DayFreelancing. Many skills can make you money as a freelancer.Drive for Uber or Lyft.Deliver Food.Complete Tasks on TaskRabbit.Pet Sitting or Dog Walking.Sell Items Online.Participate in Paid Focus Groups or Surveys.Rent Your Space.

How to make $1 000 in 24 hours

10 Legit Ways to Make $1,000 in 24 HoursSell Your Stuff.Freelance.Get a Side Hustle or Part-Time Job.Start a Blog.Start an E-Commerce Store.Invest in Real Estate.Set up Passive Income Streams.Make Money Online.

Do ETFs pay you monthly

There are 2 basic types of dividends issued to investors of ETFs: qualified and non-qualified dividends. If you own shares of an exchange-traded fund (ETF), you may receive distributions in the form of dividends. These may be paid monthly or at some other interval, depending on the ETF.

Is it OK to just invest in ETFs

If you're looking for an easy solution to investing, ETFs can be an excellent choice. ETFs typically offer a diversified allocation to whatever you're investing in (stocks, bonds or both). You want to beat most investors, even the pros, with little effort.

Can I buy index funds with $100

Consider investing your $100 in a diversified portfolio of stocks and index funds. You can either use an online broker to do it yourself or try out a robo-advisor that'll invest for you according to your needs and risk tolerance.

Are index funds too safe

The short answer is yes: index funds are still safe in the long term. Only the right index funds are safe. There may be some on the market that you want to avoid.

Are funds better than stocks

While both can help you earn solid returns, mutual funds are generally considered a safer investment than individual stocks. A mutual fund is a pooled investment containing many stocks and other assets within a single fund, while a stock is an investment in a single company.