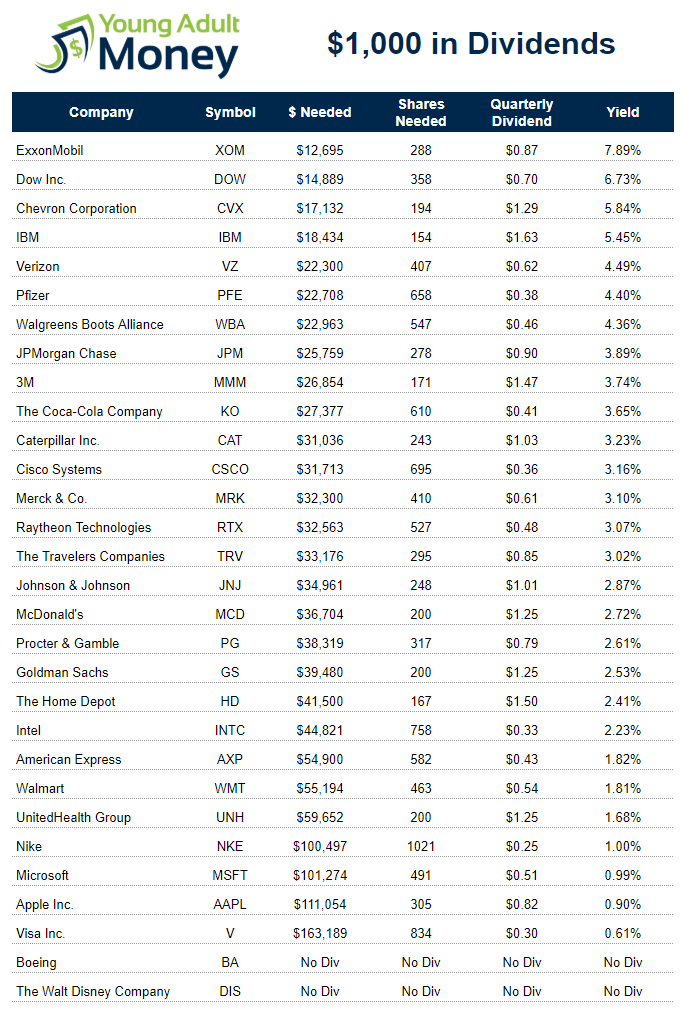

How to get $1,000 in dividends?

How to make $1,000 from dividends

The Ideal Portfolio To Make $1,000 Per Month In Dividends

Each stock you invest in should take up at most 3.33% of your portfolio. “If each stock generates around $400 in dividend income per year, 30 of each will generate $12,000 a year or $1,000 per month.”

How to get $500 a month in dividends

How To Make $500 a Month in DividendsChoose a desired dividend yield target.Determine the amount of investment required.Select dividend stocks to fill out your portfolio.Invest in your dividend income portfolio regularly.Reinvest all dividends received.

How do you make $100 a month in dividends

In order to make $100 a month in dividends, you'll need to invest approximately $40,000 in dividend stocks. The exact amount will depend on the dividend yields for the stocks you buy for your portfolio. Take a closer look at your budget and decide how much money you can set aside each month to grow your portfolio.

How much dividend will I get with $1 million dollars

So, it's likely a portfolio's overall dividend yield will be in the same range. However, the exact earnings will depend on the specific stocks held. For example, $1,000,000 multiplied by a portfolio dividend yield of 4%. Gives us $40,000 in dividends paid per year.

Does Tesla pay dividends

Tesla (TSLA) does not pay a dividend.

How to get $5,000 in dividends a month

How To Make $5,000 A Month In DividendsDevelop a long term perspective.Determine how much you can allocate for investment.Select dividend stocks that are consistent with your strategy.Invest in your selected dividend stocks regularly.Keep investment costs and trading to a minimum.Reinvest all dividends received.

What is the highest dividend stock

Stocks with the highest dividend yields in the Dow Jones Industrial AverageVerizon Communications (VZ) Verizon is a leader in communication and technology services.Walgreens Boots Alliance (WBA)3M Company (MMM)Dow Inc.International Business Machines (IBM)Chevron (CVX)Amgen (AMGN)Cisco Systems (CSCO)

How much dividend income from 500K

A $500K nest egg will create $38,000 in annual income (better than a million bucks in PFE!). Or $200K will generate $15,200 in yearly dividend income. You get the idea.

How much dividend payments on $100,000

If you have $100,000 to invest, you can easily use it to unleash a dividend stream that pays you $940 a month. That's $11,280 a year in dividends—on just $100K!

Can I live off dividends

To live off of dividend income alone, you need to receive enough dividend payments each year to cover your expenses. Once you know how much income you need to cover your expenses, you can divide that by the average dividend yield of your portfolio to get a rough estimate of how much you need to invest.

Can you live off interest of 2 million dollars

Assuming a 4% withdrawal rate, a 2 million dollar investment portfolio could potentially provide an annual income of $80,000. However, this amount may not be sufficient for some individuals or families to cover their living expenses, especially if they have high living costs or live in an expensive area.

Is Coca Cola a dividend stock

Historical dividend payout and yield for CocaCola (KO) since 1964. The current TTM dividend payout for CocaCola (KO) as of July 06, 2023 is $1.84. The current dividend yield for CocaCola as of July 06, 2023 is 3.01%.

Does Netflix pay dividends

Netflix (NASDAQ: NFLX) does not pay a dividend.

How much can you make in dividends with $100 K

Table 1: Potential Dividend Income From A $100K Dividend Stock Portfolio

| Portfolio Dividend Yield | Dividends on $100K |

|---|---|

| 1% | $1,000 |

| 2% | $2,000 |

| 3% | $3,000 |

| 4% | $4,000 |

Are dividends worth it

As such, when you own shares of a stock that pays dividends, you're really getting a bonus, so to speak. And for that reason, it's worth holding dividend stocks in your portfolio. That said, when deciding whether to buy shares of a given stock, its dividend (or lack thereof) should not be the first thing you focus on.

How much dividends does $2 million dollars make

Generally, a diversified investment portfolio that includes a mix of stocks, bonds, and other income-generating assets can yield an average annual return of around 4% to 6%. Based on this, a 2 million dollar investment portfolio could potentially generate an annual income of $80,000 to $120,000.

What will 100K be worth in 20 years

What will 100k be worth in 20 years If the nominal annual interest rate is 4%, a beginning balance of $100,000 will be worth $219,112.31 after twenty years if compounded annually.

Who pays the highest dividends

9 high-dividend stocks

| Ticker | Company | Dividend yield |

|---|---|---|

| UAN | CVR Partners, LP | 40.33% |

| NRT | North European Oil Royalty Trust | 25.29% |

| MVO | MV Oil Trust | 16.73% |

| ARLP | Alliance Resource Partners, L.P. | 15.51% |

Is $5 million enough to retire at 55

With $5 million you can plan on retiring early almost anywhere. While you should be more careful with your money in extremely high-cost areas, this size nest egg can generate more than $100,000 per year of income. That should be more than enough to live comfortably on starting at age 55.

Can I retire at 55 with $3 million

If you're retiring at 55 instead of 66, you have 11 extra years of expenses and 11 fewer years of income that your savings will need to cover. The good news: As long as you plan carefully, $3 million should be a comfortable amount to retire on at 55.

Does Amazon pay dividends

But one thing you won't get when you invest in Amazon is a stream of dividend payments. While many companies that issue stocks pay dividends on a regular basis (with some even steadily increasing their dividends through the years), Amazon doesn't pay dividends to shareholders.

Does Tesla pay a dividend

Tesla (TSLA) does not pay a dividend.

Is Google paying dividends

Dividend-Shy Google

Still other parts of Google are focused on entirely different markets, making the company something of a technological conglomerate. That being said, one of the biggest reasons why Google does not currently pay a dividend is that it wishes to continue its expansion into new ventures.

How to turn 100k into 1m

There are two approaches you could take. The first is increasing the amount you invest monthly. Bumping up your monthly contributions to $200 would put you over the $1 million mark. The other option would be to try to exceed a 7% annual return with your investments.

How to invest $100k to make $1 million

Consider investing in rental properties or real estate investment trusts (REIT). The real estate market is a fertile setting for a $100k investment to yield $1 million. And it's possible for this to happen between 5 to 10 years. You can achieve this if you continue to add new properties to your portfolio.